Open Banking

Consumer Data Right

Australia’s Consumer Data Right puts individuals and businesses in control of their data, to increase competition and transparency.

A global movement

Open Banking is taking shape across the world to give individuals and businesses better control, transparency and competitive services from their data.

In Australia, Open Banking is enabled by the

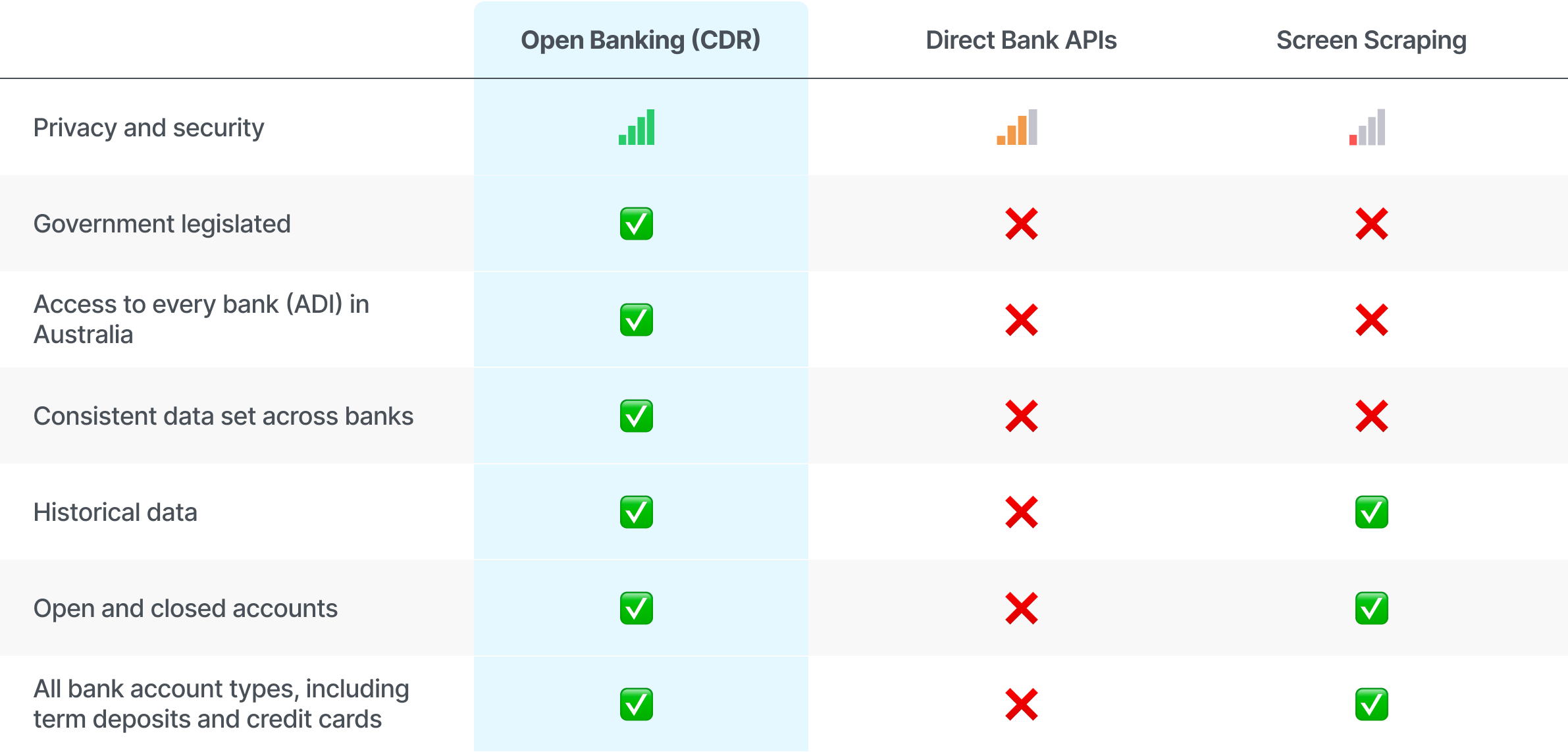

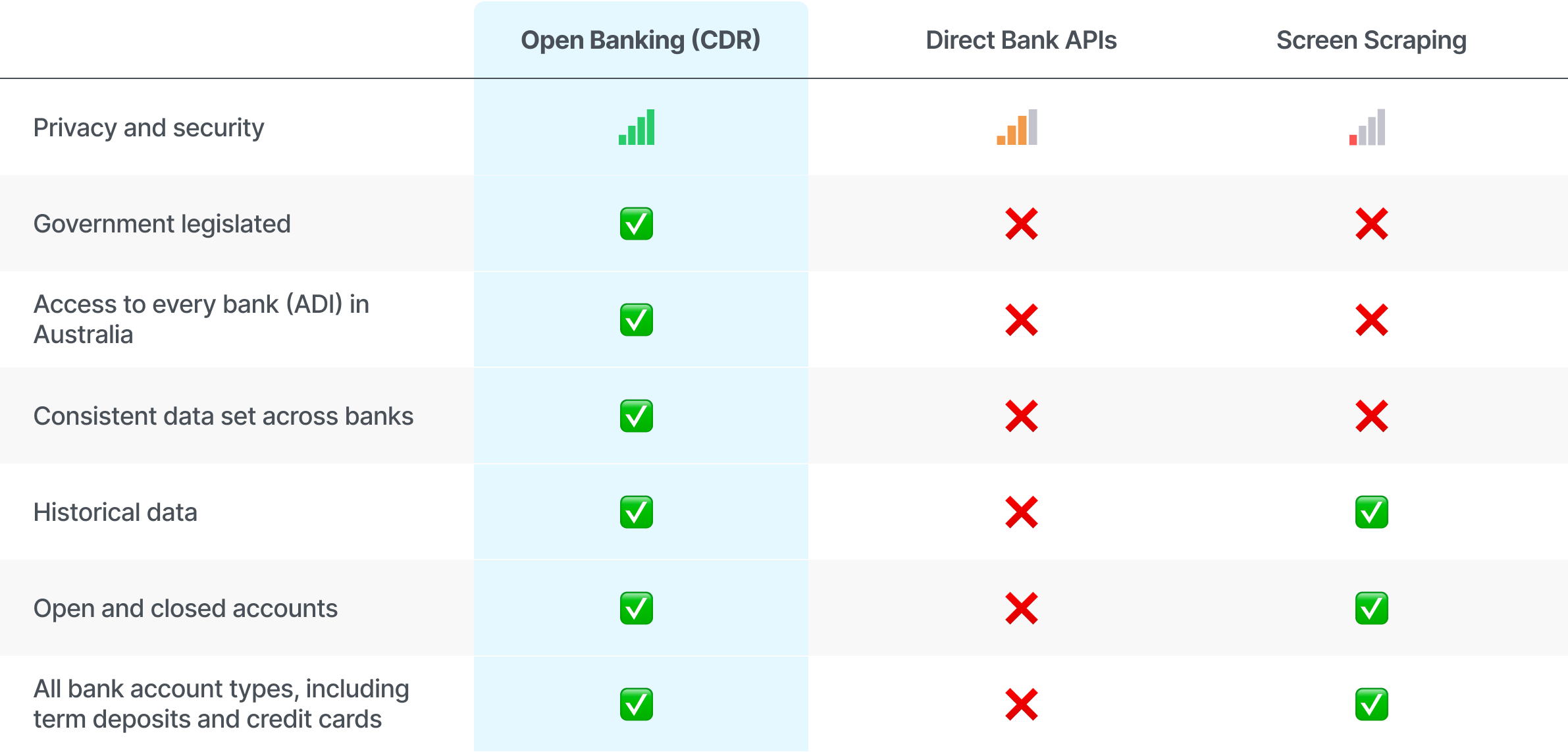

Why Consumer Data Right?

Not only do you get better quality data across every bank in Australia, but the CDR has been designed with security at the forefront to keep your data safe.

-

Privacy and security -

Government legislated

-

Access to every bank (ADI) in Australia

-

Consistent data set across banks

-

Historical data

-

Open and closed accounts

-

All bank account types, including term deposits and credit cards

Open Banking (CDR)

-

-

✅

-

✅

-

✅

-

✅

-

✅

-

✅

Direct Bank APIs

-

-

❌

-

❌

-

❌

-

❌

-

❌

-

❌

Direct Bank APIs

-

-

❌

-

❌

-

❌

-

✅

-

✅

-

✅

| Open Banking (CDR) | Direct Bank APIs | Screen Scraping | |

|---|---|---|---|

| Privacy and security |   |   |   |

| Government legislated | ✅ | ❌ | ❌ |

| Access to every bank (ADI) in Australia | ✅ | ❌ | ❌ |

| Consistent data set across banks | ✅ | ❌ | ❌ |

| Historical data | ✅ | ❌ | ✅ |

| Open and closed accounts | ✅ | ❌ | ✅ |

| All bank account types, including term deposits and credit cards | ✅ | ❌ | ✅ |

Skript is an Active Unrestricted Accredited Data Recipient

This means we’ve done all the hard work, so you don’t have to.

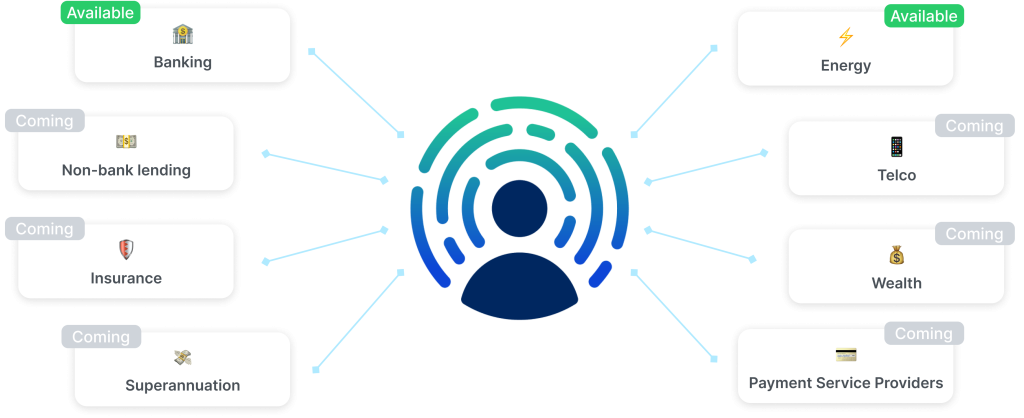

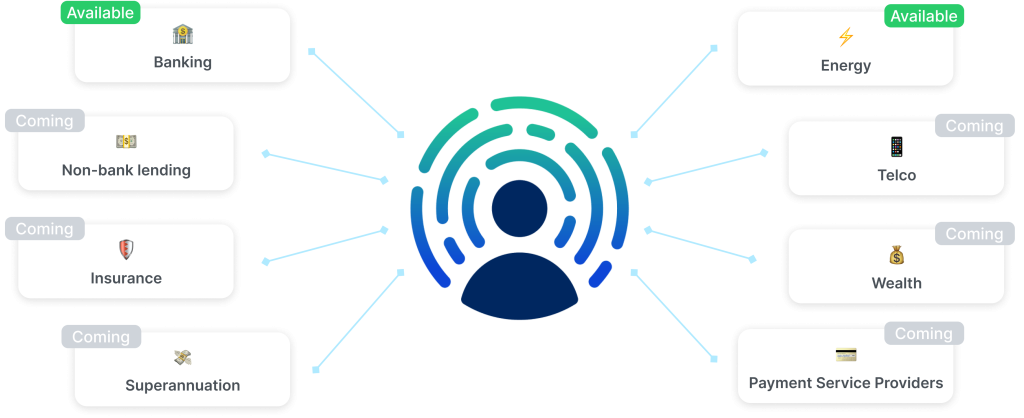

It's more than banking

The CDR is all about putting a consumer in control of their data – beyond just banking data.

Data now. Actions soon.

While CDR has started with read-only APIs, write APIs are on their way. This means consumers can instruct third parties to take actions on their behalf. Here are some instructions that could be passed through the CDR.

💵 🚀

Payment initiation

🏦 🔀

Provider switching

🪪️ ✨

Account opening or closing

Accreditation options

There are a few different ways to access Open Banking data. Skript helps customers with these 3 options.

1. Trusted Advisers

If you fall into any of these professions, you don’t need to be accredited to access CDR data.

👉 Accountants

👉 Tax & BAS agents, and financial advisers

👉 Financial counselling agencies

👉 Mortgage brokers

👉 Lawyers

2. CDR Representative

If you’re not a Trusted Adviser but still need detailed CDR data, Skript can bring you on as a CDR Representative. You will still need to comply with security requirements but this means you skip the accreditation process.

3. Insights

If you just need insights derived from CDR data, for example an account balance or average monthly income, you don’t need to be accredited at all. This is because you won’t be accessing personal information.

If you only want to access your own data, you don’t need to be accredited at all.