Income & Expense Verification

Is this you?

In order to make an informed decision on lending, credit or to provide lending brokering services, you need customers to manually share multiple documents with you. You then need to manually review and obtain insights from these documents. This is a lengthy, manual and costly process.

How Skript can help

We can provide you with a platform to automatically ingest a customer’s transaction history and categorise this to obtain insights on their financial position.

Let us show you how

You can request any information you require from your customer using Transkript.

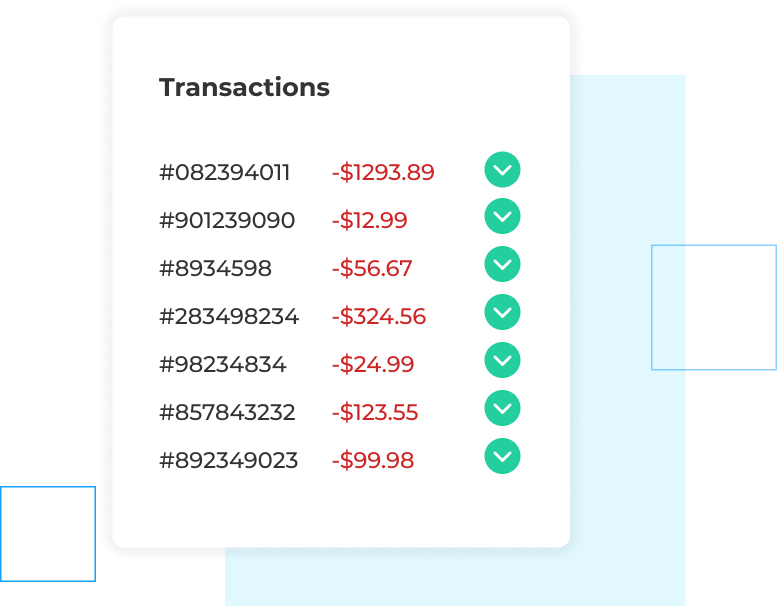

Transaction History

Get a list of your customer’s transactions directly from their bank via Open Banking. No more manual uploads and reviews of bank statements.

Account holdings

Get an overview of accounts your customer holds directly from their bank.

Assets and Liabilities

See your customer’s assets and liabilities held with their banks via Open Banking.

Documentation

Request any other information you require such as pay slips, income statements, tax statements, etc.